Purchasing your very first residence is a captivating milestone, it may also be challenging, especially when navigating the fresh new economic aspects. The good news is, Sc offers multiple programs made to help very first-time home buyers. Such software give capital, all the way down rates, and other bonuses so you’re able to reach your desire homeownership. Expertise these types of alternatives and how to availableness all of them is the key to an easier and more affordable visit getting the first family.

First-big date home customer programs is actually effort built to generate homeownership a lot more accessible, particularly for those individuals facing financial barriers. These types of applications will become deposit direction, faster interest rates, income tax credit, and you can informative resources. Of the engaging in these types of software, first-time customers normally defeat well-known barriers for example protecting to own a beneficial high advance payment otherwise qualifying to own home financing. South carolina now offers a variety of applications designed to get to know the brand new requires of first-big date consumers, making certain more folks can afford to buy its first house.

South carolina Housing’s Homeownership System is one of the most popular options for earliest-date people, giving sensible mortgage loans and you can down payment advice. This method provides repaired-speed mortgages which have competitive rates of interest or over so you’re able to $8,000 inside forgivable financing to have qualified people. To qualify, candidates need certainly to see earnings constraints, provides the absolute minimum credit rating regarding 620, and you will over an approved house visitors education movement.

A unique well-known system ‘s the Palmetto Heroes System, that provides advantages to area solution advantages such coaches, law enforcement officers, firefighters, and you may nurses. Eligible players have access to lower repaired-interest rates or more so you can $10,000 for the down payment assistance. This choice was designed to support those who suffice its organizations.

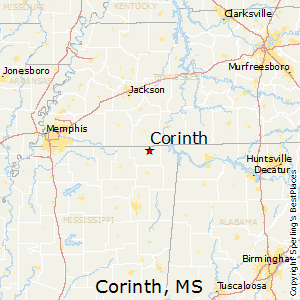

To own customers in rural areas, USDA loans provide high benefits, plus no down-payment and you may sensible interest rates. Such funds are around for those purchasing when you look at the USDA-appointed rural elements and you may who see income and you may credit rating requirements. Similarly, FHA finance try a national option popular into the Sc. They require as little as 3.5% off and you may undertake credit ratings as little as 580, leading them to perfect for people which have restricted savings or borrowing pressures.

The favorable Next-door neighbor Across the street Program is another federal effort that benefits personal servants such as for example teachers and you will EMTs. Users should buy property when you look at the revitalization areas in the up to fifty% off of the number rate, offered it agree to living in the property for at least three years.

Qualifications for first-day house customer apps varies, however, you can find common requirements candidates need satisfy. Really applications has actually income limitations predicated on domestic size and you may location, ensuring the huge benefits is directed to your those who you prefer them really. Credit score conditions generally may include 580 so you can 640, according to program. Customers must getting to purchase an initial quarters, because financing attributes are often excluded. Additionally, the definition of good “first-date visitors” have a tendency to comes with anyone who has maybe not owned a house on the earlier in the day three years.

Trying to get a first-big date home client program begins with evaluating the qualification. Knowing the earnings, borrowing from the bank, and you may property criteria on applications you’re looking for try very important. Of several programs wanted doing a property consumer degree way to set up individuals on responsibilities of homeownership. After doing the category, the next phase is to locate an approved bank signed up so you’re able to provide the program professionals. Event necessary documentation, instance proof of income, tax returns, and you will credit history, assurances an easier software techniques. In the long run, submission the application and you can protecting pre-approval for home financing ranks loan places Primrose one to with full confidence seek out your fantasy domestic.

Along with earliest-time home visitors programs, the homeowners into the Sc will get be eligible for taxation benefits. The loan desire deduction lets property owners so you can deduct the interest paid down on their financial using their nonexempt earnings. Property taxes try an alternative deductible expense, reducing the total income tax load. Certain federal and state software supply tax credit to own earliest-go out people, after that relieving the new economic challenges out of homeownership.

Advance payment guidelines applications gamble a pivotal part within the support first-big date customers. These applications give offers, forgivable finance, and you can deferred fee finance to simply help security new initial costs off buying a home. Offers bring money that do not need to be paid, if you’re forgivable financing are usually forgiven adopting the client stays in the house having a specified period. Deferred commission finance is actually paid back as long as the home comes otherwise refinancedbining these types of choices with other basic-big date customer software normally somewhat dump away-of-pouch expenses.

Pre-Approval: An important Step having Very first-Time People

Getting pre-acknowledged to possess home financing the most extremely important measures home-to acquire process. Pre-approval brings an obvious understanding of your allowance and you will reveals sellers your a significant client. It also streamlines the borrowed funds processes, ensuring an easier closure feel. Because of the securing pre-approval, you get count on and you may clearness since you navigate the marketplace and you can generate has the benefit of into the belongings.

With the amount of programs available, deciding on the best you can be challenging. Start by assessing your needs and you can deciding which type of advice-particularly advance payment help, smaller rates, or income tax credit-will benefit the most. Consider carefully your long-title preparations, for example the length of time you wish to stay-in our home, given that particular apps require home obligations. Asking professionals like realtors otherwise home loan advisers will help identify the apps most appropriate towards the condition.

First-day consumers will deal with demands, but knowing well-known downfalls makes it possible to avoid them. Missing pre-approval can also be impede the process and relieve the bargaining fuel. Disregarding hidden will cost you such monitors and you may closing fees is also filter systems your finances. Attending to exclusively towards price, unlike provided community high quality otherwise property condition, can result in enough time-name disappointment. In the end, overlooking program due dates otherwise qualifications criteria can cause overlooked opportunities. Staying advised and hands-on ensures a smoother household-purchasing sense.

Integrating with Jeff Plan A property

At Jeff Plan A house, i focus on enabling first-time buyers browse the reasons of buying a house. We offers individualized guidance, hooking up you into top software to fit your needs. With deep local training, we always find the right home on primary location. Off assets online searches so you’re able to closing, we provide total service each step of one’s ways, turning your ideal out-of homeownership towards possible.

Initiate Your own Visit Homeownership

Southern Carolina’s basic-date domestic consumer software give rewarding info to make purchasing a good family significantly more available. From the knowledge the options and dealing with knowledgeable professionals, you might grab the foundation of finding your ultimate goal out of homeownership. Contact Jeff Prepare Real estate right now to learn more about these apps and how we are able to assist you in finding the perfect domestic.

Leave a Reply