(Equity Ratio is a representation of the total equity that the company has as a percentage of the total assets. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Free Cash Flow (FCF): Formula, Analysis, Examples

Lastly, they can restructure or refinance their debt to secure more favorable terms, potentially lowering the overall debt level. Each method requires careful planning and execution, with the goal of achieving a more balanced and sustainable financial structure. The gearing ratio is a powerful tool because it provides insights into a company’s financial structure and risk profile. A high gearing ratio suggests a company has significant debt, which could be a red flag for potential investors or lenders. Conversely, a low gearing ratio indicates that a company is primarily financed by equity, which may suggest a more conservative approach to financing. It’s also important to remember that although high gearing ratio results indicate high financial leverage, they don’t always mean that a company is in financial distress.

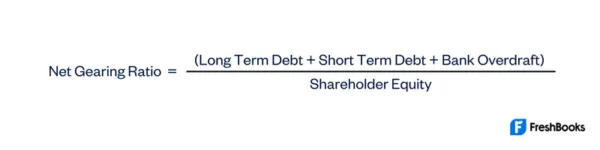

Gearing ratio formula

- This article tells you everything you need to know about these ratios, including the best one to use.

- Many shareholders prefer sourcing capital from debt rather than equity as issuing more shares of stock can dilute their ownership stake in the company.

- By examining these ratios, stakeholders can better understand the balance between debt and equity in a firm’s capital structure.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Otherwise, ABC will be forced to either provide a guarantor or mortgage any property. The Interest Coverage Ratio measures the ability to cover interest expense from year to year rather than the overall solvency of a company. As interest rates rise, Interest cover is becoming a more important metric again. For many years when Central Bank’s pursued quantitative easing policies, interest rates were so depressed, that even in relatively leveraged companies, interest cover was not a problem. Now that interest rates have risen from negative numbers in Euros to 3%, interest cover is now indicative of real risk. Furthermore, companies can negotiate with their lenders to convert any existing debt into equity shares.

Debt to equity ratio

The result shows a comparison between total assets owned by the company versus shareholders’ ownership. A high ratio indicates that a good portion of the company’s assets are funded by debt. The capital gearing ratio is the ratio of all capital with a fixed return (i.e., preference share capital plus long-term liabilities) to all capital with a variable return (i.e., ordinary share capital).

What is the formula to calculate the capital gearing ratio?

In this edition of HowStuffWorks, you will learn about gear ratios and gear trains so you’ll understand what all of these different gears are doing. You might also want to read How Gears Work to find out more about different kinds of gears and their uses, or you can learn more about gear ratios by visiting our 4 popular free and open source accounting software gear ratio chart. Although financial leverage and financial risk are not the same, they are interrelated. Measuring the degree to which a company uses financial leverage is a way to assess its financial risk. A company whose CWFR is between 30% to 50% of its total capital employed is said to be medium geared.

Reduce Costs

Key figures such as total liabilities, shareholders’ equity, earnings before interest and taxes (EBIT), and interest expenses are essential for these calculations. Gearing ratio measures a company’s financial leverage, the level of interest-bearing liabilities in its capital structure. It is most commonly calculated by dividing total debt by shareholders equity. Alternatively, it is also calculated by dividing total debt by total capital (i.e. the sum of equity and debt capital).

Net gearing can also be calculated by dividing the total debt by the total shareholders’ equity. The ratio, expressed as a percentage, reflects the amount of existing equity that would be required to pay off all outstanding debts. Gearing ratios are important financial metrics because they can help investors and analysts understand how much leverage a company has compared to its equity. Put simply, it tells you how much a company’s operations are funded by a form of equity versus debt.

Internal management also uses these ratios to analyze their future profit and cash flows. Usually, where high investment is involved, gearing ratios tend to be higher as they have to afford those. Usually, where high investment is involved, gearing ratios tend to be higher as they have to afford those CapEx via externally secured fundings. A company’s financial leverage is its total assets divided by its shareholders’ equity.

Financial leverage shows the degree to which the operations and the overall company if funded with equity financing versus debt financing. Gearing ratios are also a convenient way for the company itself to manage its debt levels, predict future cash flow and monitor its leverage. A company with a high gearing ratio will tend to use loans to pay for operational costs, which means that it could be exposed to increased risk during economic downturns or interest rate increases. Another strategy involves refinancing existing debt to secure more favorable terms.

A gearing ratio is a useful measure for the financial institutions that issue loans, because it can be used as a guideline for risk. When an organisation has more debt, there is a higher risk of financial troubles and even bankruptcy. It’s also worth considering that well-established companies might be able to pay off their debt by issuing equity if needed.

Leave a Reply