Discover the differences when considering these two repair loans, and how both work with money renovations.

Before RenoFi Loans arrived, both most typical choices for buyers seeking to re-finance (or get) and remodel property all-in-one loan was basically Fannie mae Homestyle and FHA 203k finance.

RenoFi Money are extremely, and in some cases they are the best choice to invest in family home improvements, nonetheless they aren’t right for men. Usually when this is the situation, homeowners look to either HomeStyle finance or FHA 203ks, but do not learn how to choose from these types of.

Both enables you to refinance and lso are house, but there are well-known distinctions which could generate Fannie Mae Homestyle restoration funds the higher solutions more than a keen FHA 203k for the majority residents.

You have grown up to enjoy where you happen to live, but you outgrown your residence. You could disperse, but it will get imply going for within best domestic plus the correct people. Thus you’re considering a primary renovation endeavor, but do not really know what your financial support options are.

It’s likely that you have heard of Fannie mae HomeStyle or FHA 203K recovery loans, but aren’t yes exactly how this type of money really works when undertaking household advancements in your current house.

Within this book, you will then see exactly how both of these kind of repair mortgage examine, and additionally discovering RenoFi Finance, an alternative that might be top suitable for your needs.

Exactly what are FHA 203k & HomeStyle Recovery Finance?

One another FHA 203k and you can HomeStyle repair financing will let you finance the acquisition or re-finance and you can renovation off property during the a good unmarried mortgage.

Such mortgages enable you to borrow against your house’s upcoming worth, increasing your borrowing from the bank strength when compared to a vintage home equity mortgage otherwise line of credit.

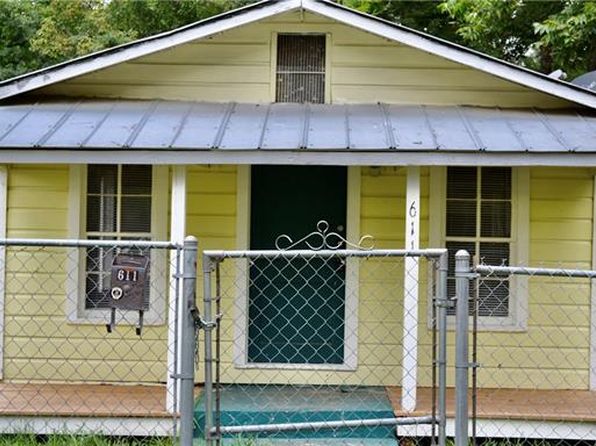

Whether you dropped in love with a great fixer-top and want to purchase the home and be it to the your dream family, or possess an extended wishlist of home improvements to show your existing property to the perfect area to you plus relatives, these funds can assist you to do that now.

You either pick a special family which you have located playing with an excellent antique mortgage, embark on staying in your home knowing it demands performs, would home improvements a little while immediately over age, or you select a financing option one lets you do everything instantly.

Therefore the most borrowing from the bank power that is included with credit facing your house’s coming value makes it much personal loans in Hawai simpler to obtain the full number you prefer today, unlike having to generate compromises about what programs your deal with and having to wait up to yet another big date.

Tips off Fannie mae Homestyle & FHA 203k Fund When Remodeling

Your use predicated on their just after recovery worthy of (ARV) – Which most significant differentiator of one another Homestyle and you may FHA 203K money in place of antique fund would be the fact these include according to research by the ARV, otherwise after restoration value, of your property; perhaps not brand new home’s current value.

They substitute & pays your current mortgage – If the being used to help you remodel an existing household, you’re required to re-finance your mortgage when taking aside a keen FHA 203k or Fannie mae Homestyle financing.

Along with acquisition to accomplish this, you pay it well. These repair fund range from the a lot more finance to cover the bill of first-mortgage, additionally the costs to cover home improvements and any closing costs.

Pricing are typically highest – Keel in mind that one another HomeStyle and you can FHA interest rates assortment away from .5% to one% higher than conventional home loan prices, meaning higher monthly payments.

Leave a Reply