Why does the lender you would like my personal lender comments and how create I see all of them?

Why you to definitely a home loan company needs to appear at your lender statements, is to try to acquire a much better comprehension of you as a person and to see just what youre just as in spending your finances. Your existing speech people funds, can affect the quantity you need acquire.

All this work boils down to the risk to a home loan company. They should know that youre an accountable borrower and are designed for your money when you look at the the right manner. A mortgage is the largest financial commitment you are actually most likely and make, very mindful think and you may planning will have to get into it.

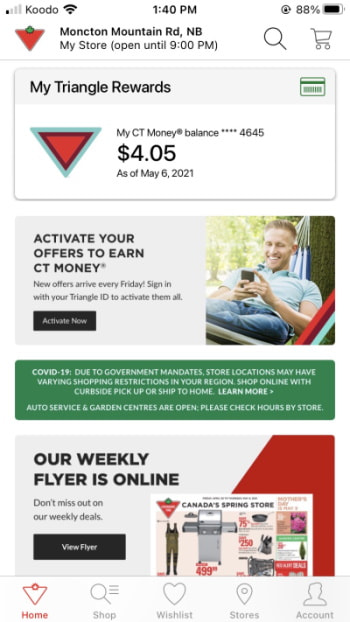

You can easily get their lender comments both from your financial non-prescription, about blog post, or the greener option additionally utilized today, given that a file either emailed from your financial otherwise found in your web banking, from which you could potentially printing from.

What is going to loan providers be looking having to my bank statement?

So taking a look at the fundamental matter, what will the loan financial become examining getting on my lender report? What is going to banner upwards by itself?

Really as the discussed before, they want to understand you happen to be becoming in control together with your funds. Something right off the bat, is actually they are looking to see if you really have one overdrafts.

Entering your overdraft actually totally crappy, even if entering it have a tendency to is also leave a mortgage lender in order to question even when you can be respected.

It’s also advisable to be sure that you careful which have potential came back Direct Debits, which may head a loan provider to trust you are unsound which have your money. In addition, revision the lender of all outbound purchases, because neglecting to disclose people can get eliminate their believe.

As well as the scenario having any borrowing, continually be careful of skipped costs on the signature loans, playing cards, etc. As much as possible reveal having the ability to see monthly work deadlines, that is attending work with their favour having a home loan bank.

We would will assist! Get rid of our team an email otherwise concern and we’ll score back into reach instantly.

Often playing apply at my likelihood of providing a home loan?

Our company is daily requested this by consumers, as much a home loan candidate can find by themselves with difficulties progressing, on account of a reputation gaming.

quick payday loans Crested Butte

A little bit of fun most of the occasionally isn’t as well ruining, but apparently playing large volumes, whether you are and make your finances right back or not, does not seek out favorable so you can a lender at all.

Exactly what can I really do to show the financial institution I am legitimate?

Through the our go out working in the loan community, helping people to track down first time buyer mortgages or to circulate household, we typically discover that lenders like to see the last 3 months lender comments.

Influence one to planned, you should look at today’s and upcoming, not your earlier. You will find no less than 3 months online, to properly break upon your finances and you can change your approaching of the income and you will outgoings.

Our very first suggestion is when you apparently go to a city bookmakers otherwise explore betting websites on line, you ought to take some slack for some time. This is bound to replace your economic system plus mental state too, because the gambling might have been recognized to has a detrimental effect on rational really-becoming.

After the for the out of this, we might suggest while making plans to initiate saving your money. Would you like to date getting dining or might you prepare inside? Do you need to lose you to ultimately low-basics, or perhaps is sooner or later getting their home loan a delicacy by itself?

There clearly was plenty you could do in order to fundamentally put on your own regarding the greatest reputation getting releasing right up finance to blow all your debts with time and you may establish one another affordability and you will accuracy with a home loan financial, ahead of a mortgage application.

Basically, this all comes down to being practical and you will thinking ahead from day towards the stuff you would like to reach. Brand new subsequent in the past one expense and you may economic uncertainty try, the higher reputation there are having a home loan company.

Talk to a loyal Home loan Mentor

Even when youre a first and initial time consumer trying out very first previously mortgage techniques, swinging family and in demand for home loan recommendations or are searching within self-employed mortgages, the main is to try to often be accountable for your money.

If you find yourself experiencing a bad credit history, there is certainly poor credit mortgages available to you around, though we might always recommend taking out fully expert home loan recommendations when you look at the purchase to put oneself on the number 1 place for taking with the the mortgage journey.

Leave a Reply