Other assets encompass a broad category of non-current and non-liquid assets not explicitly classified elsewhere, contributing to an entity’s overall asset liquidity profile. Goodwill represents the premium paid for acquiring a business above its tangible assets’ fair value and is considered an intangible asset with potential liquidity implications in financial analysis. Accounts receivable represent amounts owed to a company for goods or services provided, and while they are assets, their liquidity can vary based on payment terms and customer creditworthiness. The order of liquidity is important for businesses because it provides a framework for making investment decisions. In short, the order of liquidity concept results in a logical sort sequence for the assets listed in the balance sheet. Compare the profit potential of FX and crypto trading from both trader and broker perspectives to determine which market suits your financial goals.

In which order assets and liabilities of a company are usually marshalled?

“Marshalling” refers to a creditor’s right to realize his or her debt from assets acquired by another secured creditor. “Contribution” deals with the situation where two or more creditors have competing liens on one piece of property. Specifically, permanent assets are shown first and less permanent assets are shown afterward. Stay tuned to learn how to calculate order of liquidity and why it is crucial for financial analysis. Therefore, it helps in making informed judgements about the financial risk and creditworthiness of the company. Join me on this enlightening journey as we unravel the intricacies of liquidity and its order, empowering you with valuable insights that can elevate your understanding of the financial world.

Part 2: Your Current Nest Egg

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Under the order of liquidity method, an organization’s current and fixed assets are entered in the balance sheet in the order of the degree of ease with which they can be converted into cash. This ratio measures the extent to which owner’s equity (capital) has been invested in plant and equipment (fixed assets). A lower ratio indicates a proportionately smaller investment in fixed assets in relation to net worth and a better cushion for creditors in case of liquidation. The presence of substantial leased fixed assets (not shown on the balance sheet) may deceptively lower this ratio. In general, having a high amount of cash or cash equivalents indicates a high level of liquidity.

- The Biden administration already has in place a number of bans on the export of AI chips and models.

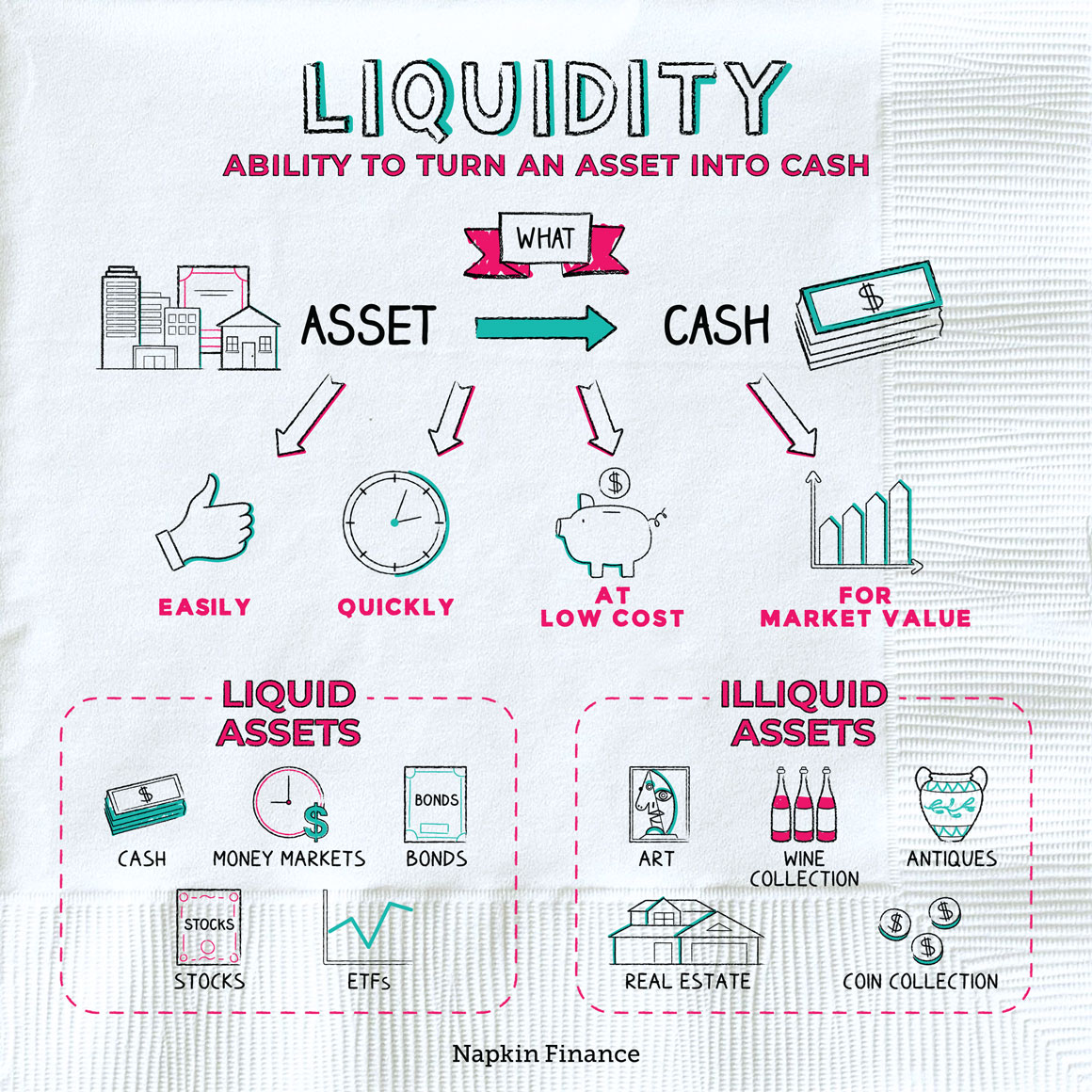

- The concept of liquidity can be applied to any business organization, securities, real estate, vehicles, and various items owned by an enterprise or an individual.

- The difference between the highest bid and the lowest ask, known as the bid-ask spread, is a direct reflection of the market’s liquidity.

- Understanding the order of liquidity helps individuals and businesses make informed decisions about asset management and cash flow planning.

What is the approximate value of your cash savings and other investments?

Understanding and managing liquidity risks is essential for optimizing financial performance and mitigating unexpected market fluctuations. In this example, you can see that the assets and liabilities are listed in the order of their liquidity. The most liquid assets (cash) are listed first, and the least liquid (intangible assets) are listed last. Similarly, for liabilities, those that are due soonest (accounts payable) are listed first, and those that are due in the longer term (deferred revenue) are listed last. This order of liquidity provides a clearer picture of the company’s financial situation, showing how well it can meet its short-term obligations and how effectively it can convert its assets into cash.

Why You Can Trust Finance Strategists

While these assets may not be easily converted into cash, they still hold value and play a crucial role in the financial stability of a company. Next, the money owed by the business in the normal course of sales, which is accepted by the general credit terms of the company, is generally known as accounts receivables. Next, inventory is the stock lying with what does order of liquidity mean the company and can be converted into cash from one month to the time of sales. Sometimes inventory can be sold quickly, so its position may vary from organization to organization. Then comes the non-current assets like plant and machinery, land and building, furniture, vehicles, etc.; they need a longer selling period and thus need time in liquidation.

order of liquidity Financial definition

This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

It’s calculated by subtracting inventories from current assets and then dividing by current liabilities. Individuals and companies with plenty of free cash or easily sellable assets like stocks have high accounting liquidity. Companies with ample liquid assets are better equipped to navigate economic recessions, industry slowdowns, or unforeseen challenges. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

Liquidity, or accounting liquidity, is a term that refers to the ease with which you can convert an asset to cash, without affecting its market value. In other words, it’s a measure of the ability of debtors to pay their debts when they become due. Essentially, the easier it is to sell an investment for a fair price, the more “liquid” that investment is considered to be. Naturally, cash is the most liquid asset, whereas real estate and land are the least liquid asset, as they can take weeks, months, or even years to sell. Assets are typically categorized into different levels of liquidity, forming a hierarchy that reflects their ease of conversion into cash.

Understanding the order of liquidity is paramount for investors, as it informs their asset allocation decisions, risk management strategies, and the assessment of investment opportunities. By recognizing the liquidity hierarchy of assets, investors can tailor their portfolios to align with their liquidity preferences, investment horizon, and risk tolerance. In essence, liquidity serves as the lifeblood of financial markets, fostering efficiency, stability, and confidence among market participants. It underpins the smooth functioning of trading activities, supports price discovery mechanisms, and enables investors to deploy their capital effectively. Examples of such assets include long-term investments, prepaid expenses, deferred tax assets, and intangible assets like goodwill.

By prioritizing quick conversion of receivables into cash, businesses can enhance their financial stability and agility in the face of changing market conditions. The ease with which an asset can be converted into cash or a liability can be covered reflects a company’s liquidity, which is a vital element in understanding its financial health. Welcome to the fascinating world of finance, where liquidity plays a pivotal role in shaping the dynamics of investments and financial markets. Understanding the concept of liquidity and its order is crucial for investors, financial analysts, and anyone interested in comprehending the intricacies of the financial landscape. This article aims to unravel the significance of liquidity and delve into the concept of order of liquidity, shedding light on its implications and real-world applications. Order of Liquidity can be described as a listing criterion specified by applicable accounting GAAP, which decides the order of assets presentation in its balance sheet according to its cash generation capability.

Leave a Reply