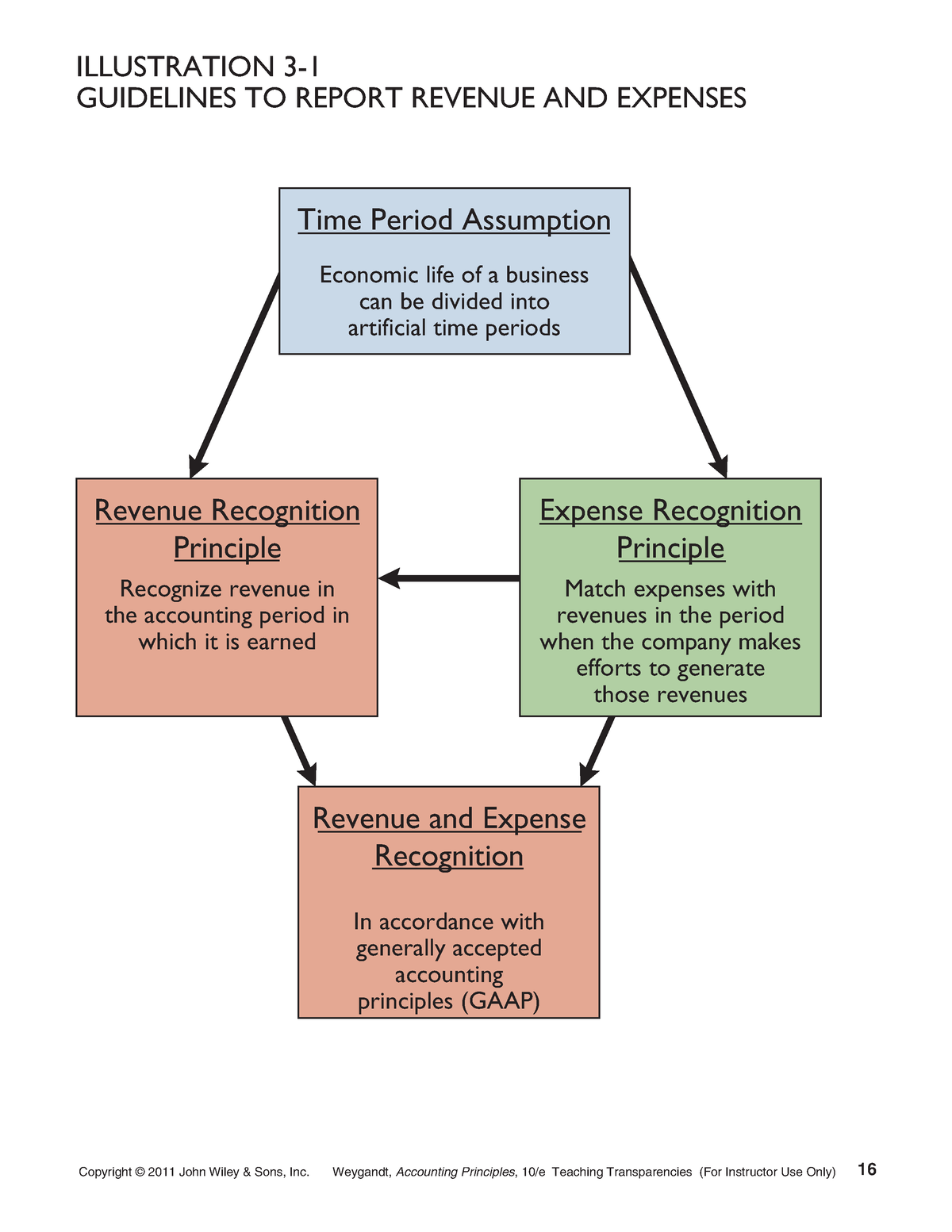

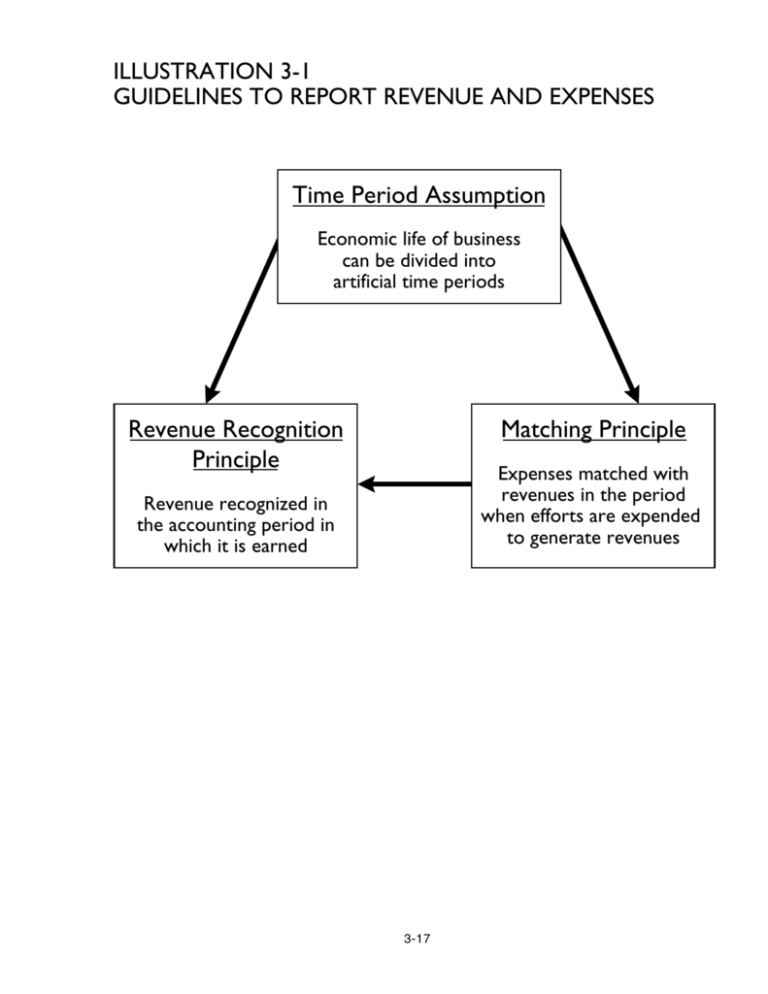

The accounting guideline that allows the accountant to divide up the complex, ongoing activities of a business into periods of a year, quarter, month, week, etc. The precise time period covered is included in the heading of the income statement, statement of cash flows, and the statement of stockholders’ equity. The income statement tells interested parties how profitably the company has carried out its operations during the period and balance sheet discloses the financial position of the business at the end of the period. The concept of the time Period assumption is a fundamental principle in accounting that allows businesses to measure their financial performance over specific intervals, known as reporting periods.

What is the approximate value of your cash savings and other investments?

This narrative is guided by the realization principle, which stipulates that revenue should be recognized when it is earned, regardless of when the cash is received. However, the temporal dimension introduced by the time period assumption adds layers of complexity to this seemingly straightforward principle. The periodicity assumption or time period assumption states that businesses can divide up their activities into artificial time periods.

The time period principle and other accounting principles

This approach provides a more accurate picture of a company’s financial performance and position at any given time. The time period assumption divides the complex, ongoing activities of a business into periods of time, such as months, quarters, or years, to provide timely information to users of financial statements. The realization principle, on the other hand, stipulates that revenue should only be recognized when it is earned and realizable, regardless of when cash is received. The time period assumption is a fundamental principle in accounting that allows businesses to divide their complex financial activities into manageable intervals, typically monthly, quarterly, or annually. This assumption is crucial for providing a clear and consistent framework for reporting financial results, budgeting, and forecasting. It enables stakeholders to make comparisons over time, assess performance, and make informed decisions based on the temporal patterns of revenue and expenses.

- From a company’s viewpoint, adhering to GAAP is crucial for maintaining credibility in the market.

- Investors often rely on GAAP-compliant reports to make informed decisions, as these documents present a true and fair view of a company’s financial health.

- A time period assumption in accounting means that a company uses financial reporting based on its own chosen periods.

The time period principle

The time period assumption, a fundamental principle in accounting, posits that business operations can be recorded and reported over specific periods. This assumption is integral to accrual accounting, which records financial events based on economic activity rather than actual cash flow. Conversely, cash accounting is predicated on the exchange of cash and does not recognize receivables or payables.

Each accounting basis can be imagined as a collection of accounting rules and principles that determine how accountants should record transactions under that basis. Companies engaged in long-term contracts, such as those in the aerospace industry, face unique challenges. They must estimate costs and revenues over the duration of the contract and recognize them in their financial statements periodically. This often requires sophisticated accounting techniques to ensure that the financial reports accurately reflect the ongoing work.

This division is not just a matter of convenience; it is a requirement for compliance with accounting standards and regulations. While the time period assumption remains a fundamental aspect of accrual accounting, its future application will likely be influenced by technological advancements, changing stakeholder needs, and regulatory reforms. For example, consider a company that enters into a contract in December but doesn’t deliver the goods or services until January of the following year. According to the time period assumption, the revenue from this contract should not be recognized until the delivery month, even if the payment was received in December. This practice aligns with the accrual basis of accounting, which matches revenues with the expenses incurred to generate them, regardless of the timing of cash flows. In the realm of accrual accounting, the fiscal year serves as the cornerstone for financial reporting and analysis.

From an investor’s perspective, the time period assumption is vital for assessing a company’s performance trends over time. Investors rely on periodic financial statements to make informed decisions about buying, holding, or selling stock. If a company chooses to defer revenue recognition, it may appear less profitable in the short term, potentially affecting stock prices and investor confidence. Investors and creditors want the most current information possible to base their financial decisions on.

As businesses continue to innovate, the methods by which they report their financial performance must also evolve. The focus will likely be on creating a model that is both reflective of the economic realities of modern business and fair to all stakeholders involved. A prime example of the time period assumption in action is the quarterly financial reporting by publicly traded companies. For instance, a retail company may report higher revenues in Q4 due to holiday sales, which wouldn’t be apparent if financial activities were only reported annually. The periodicity assumption, also known as the time period assumption, is an accounting guideline which states that the economic life of a business can be divided into artificial time periods.

The time period principle is rigorously enforced, because a high degree of consistency is needed in reporting financial statements. By following this principle, your organization can produce financial statements that are comparable to the results reported for prior years. This is needed by investors, lenders, and others who read the financial statements, and who may want to conduct multi-period analyses. The Time Period Assumption requires that the company divides its business activities into equally measured time intervals which are called accounting periods. Just like the time period principle, there are a few other accounting principles with are also concerned with income measurement assumptions. The financial statements of any business tell a story of the business’s activities and their position at a certain point in time.

Normally, an accounting period consists of a quarter, six months or a year depending on the needs of business entity and its stakeholders. In financial terms, a time period is often referred to as the accounting year, or accounting and reporting time periods. These periods can be quarterly, half yearly, annually, or any other interval depending on the business’ and owners’ preference.

freshbooks vs nonprofit treasurer 2021 in accounting is a fundamental principle that enables businesses to communicate financial information in a useful and standardized manner. It posits that a business’s complex and ongoing financial activities can be divided into shorter periods, such as months, quarters, or years. This division allows for the presentation of financial statements that are timely, relevant, and comparable across different time frames.

Leave a Reply