No money-Out: Virtual assistant re-finance guidelines specify that Virtual assistant IRRRL will not allow it to be dollars withdrawals. The mortgage number is only able to security the existing mortgage balance, qualified settlement costs, or more in order to one or two disregard factors to reduce the rate of interest. Faster Rate of interest: The primary purpose of brand new Virtual assistant IRRRL will be to safe a good straight down interest and reduce monthly payments. It can also key out of a varying-rates mortgage (ARM) so you’re able to a fixed-rate financial. No Assessment Expected: Usually, an assessment is not needed to possess a Va IRRRL, and that simplifies the procedure and you will decreases will set you back. Zero Credit Underwriting Plan: Good Virtual assistant IRRRL always doesn’t need a cards underwriting package. However, specific loan providers have their conditions. Capital Payment: The fresh Va IRRRL qualifies to own a lower life expectancy capital fee, in fact it is within the financing balance. Occupancy Criteria: Va re-finance advice require certification that the experienced in installment loans online in Kentucky the past occupied the fresh property. But not, brand new experienced doesn’t need to undertake the house or property at the period of the refinance. Settlement costs: The newest closing costs can be rolling towards the brand new mortgage, enabling the new experienced to help you refinance with restricted upfront will cost you.

Influence Qualification: Ensure you qualify getting a great Va IRRRL. Generally speaking, you really need to have a current Va financing. Favor a loan provider: Get a hold of a good Virtual assistant-approved financial to deal with the latest refinance. Offer Paperwork: Although minimal, you should offer certain documents, like your most recent mortgage declaration and evidence of earlier occupancyplete the process: Work with their financial to complete the fresh re-finance, together with investing one applicable costs and you can completing the closure.

This new IRRRL having Virtual assistant is a superb selection for pros curious to help reduce their attention rate and you will monthly premiums in place of discussing the complexity and expenditures out of an elementary refinance. However, this is not designed to offer cash-aside professionals. To gain access to your house security, think a Va cash-away re-finance as an alternative. Additional refinancing choices are available with Va mortgage brokers to suit individuals economic need. Insights Virtual assistant refinance advice makes it possible to pick the best option to suit your state.

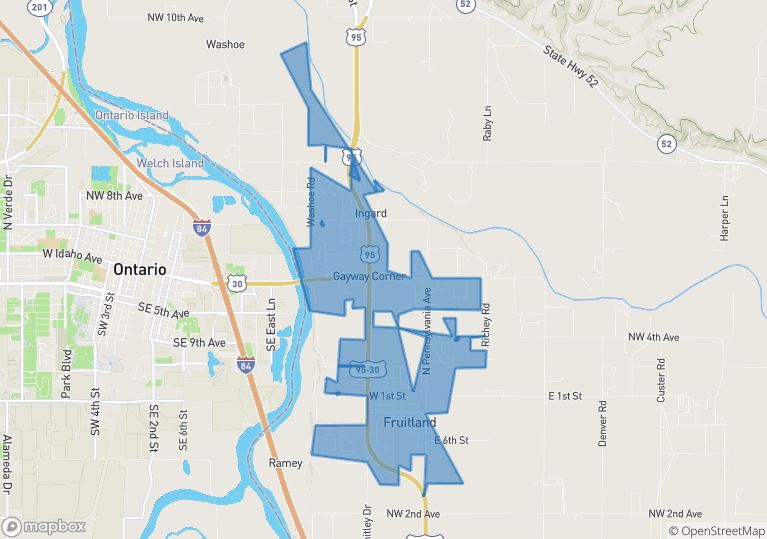

Va Financing Limits

Brand new Company off Experienced Facts does not have a maximum Virtual assistant Amount borrowed Specifications. This new Virtual assistant no longer has a max amount borrowed that they will guarantee to the a great Va Loan. New Va Loan Verify matter used to be 25% of your Va mortgage. Including, in the event that a certain Bank have a tendency to originate and you can loans a $300,000 Virtual assistant real estate loan, this new Department regarding Seasoned Affairs guarantees 25% of this Virtual assistant Amount borrowed into bank no matter if the debtor was not to pay the mortgage loan and you may enter into standard.

Lenders always lay maximum Virtual assistant Loan restrict they will money which used is $647,2 hundred unless of course the home is found in a high-pricing area like other components of California. However, the new laws eliminated maximum Va Mortgage Limitation with the Va Home loans.

How many times Is it possible you Refinance IRRRL?

Based on Virtual assistant refinance direction, there’s no certain limitation on the amount of times you can also be refinance your Virtual assistant financial having fun with mortgage Protection Home mortgage refinance loan (IRRRL). Yet not, you can find crucial considerations and requires to remember:

Trick Factors getting Refinancing that have an IRRRL:

- Internet Concrete Benefit: The fresh refinancing is to promote a definite advantage to the debtor, particularly a lower life expectancy interest rate or a range from an adjustable-rates mortgage (ARM) to help you a predetermined-price mortgage. Based on Va refinance guidance, loan providers will see whether the re-finance improves the borrower’s financial situation.

- Seasoning Criteria: Virtual assistant refinance recommendations generally need a flavoring period before you could re-finance having an IRL. The high quality needs is to try to make at the least six straight monthly payments on the existing Va financing. The loan is going to be no less than 210 months old on the first payment big date to be entitled to refinancing.

Leave a Reply