- Down-payment Expected: $ (25% x $20,350)

That it same buy determined having fun with a conventionally financed (low Virtual assistant) financing program you will definitely require the consumer to put 5%, 15% if you don’t 20% down.

Conventional Financing

- 5% Downpayment: $29,000

- 15% Down-payment: $ninety,000

- 20% Deposit: $120,000

- 5% Downpayment: $thirty five,000

- 15% Down payment: $105,000

- 20% Down-payment: $140,000

Perhaps you have realized, there clearly was a significant work for having Servicemembers and you may Pros whether or not it relates to the level of cash you’ll need for a downpayment when buying a home.

4: Aggressive Rates

As the Va pledges a fraction of all of the Va loan, loan providers could offer all the way down interest rates in order to Va consumers. Cost derive from the newest inherit exposure presumed from the lender to finance the borrowed funds. New VA’s make certain will bring loan providers that have a sense of protection that allows them to costs well lower prices.

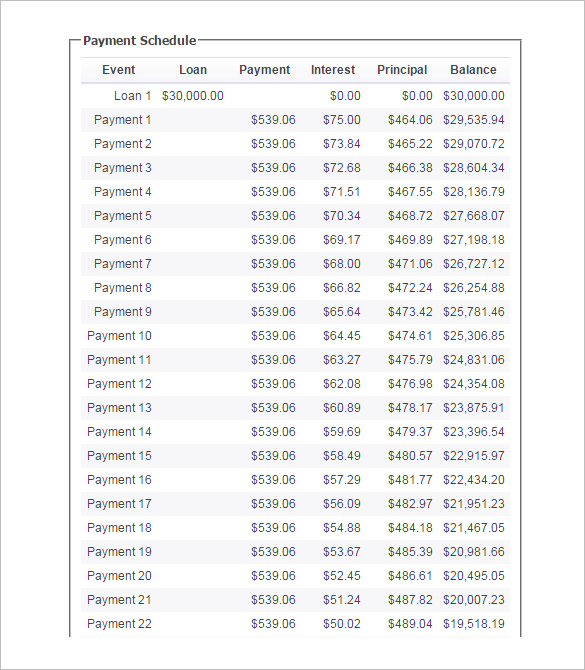

With the a thirty-year $250,000 loan, the essential difference between expenses a beneficial 4 % and cuatro.75 percent price often means approximately $forty,000 inside the discounts along side longevity of the loan.

5: Relaxed Borrowing Criteria

Since the Company out-of Pros Factors simply oversees the mortgage program and will not indeed situation financing, the fresh department doesn’t set or enforce credit history minimums. Although not, really Virtual assistant loan providers have fun with credit history criteria to evaluate an effective borrower’s threat of standard. Normally, lenders select a credit history with a minimum of 620. Additionally, Virtual assistant Mortgage brokers are usually be a little more flexible with regards to to help you moving straight back after a bankruptcy proceeding otherwise foreclosures.

For a traditional mortgage, Pros will often need certainly to see a higher standard. The average conventional client had a FICO score throughout the fifty products more than an average Va buyer in the 2016.

Every mortgage loans feature charge and settlement costs. However the Virtual assistant in reality limitations what Experts would be recharged when it comes to this type of expenses. Particular costs and charges need to be included in most other parties in the the transaction. These types of shelter make homeownership cheaper to possess certified homeowners.

Virtual assistant borrowers may ask a provider to invest every one of its loan-relevant closing costs or more to help you cuatro percent into the concessions, that may security things like prepaid taxes and you will insurance coverage, repaying series and you will judgments and a lot more. There’s no make sure the merchant tend to agree to one consult, but Pros can certainly inquire during the negotiation processes.

7: Lifestyle Work for

One of the most prominent misconceptions concerning Va financial program is that it’s a one-date work for. In reality, people with gained it will utilize this program over and over once again in their lifetimes. Even after what you may have often heard, you do not fundamentally need to pay back the Va loan in full to track down a differnt one.

It’s also possible loans in Bennett to own more than one Virtual assistant loan during the once. Utilizing your financial work for ages ago does not mean you happen to be no more eligible. Nor will it indicate that because you has actually an excellent Virtual assistant financial at the latest duty station, you can not get once more which have a Virtual assistant financing after you Pcs across the country. When you yourself have any queries concerning your Virtual assistant loan entitlement otherwise what would become you’ll, contact us and we will place you in contact with a VA-official financial.

People comprehend how much cash they are able to rescue if you are paying from other loan early, but are often obligated to shell out prepayment punishment whenever they need to to achieve this. Prepayment charges are produced to protect lenders throughout the financial loss off losing numerous years of desire repayments to the approved financing. Thankfully into Virtual assistant Mortgage benefit, you could pay your loan very early and in the place of fear of of any prepayment charges.

Leave a Reply