Having good 650 credit rating, exactly what are my potential?

- Statements

The newest Legitimate Money Mentor support a reader know how a case of bankruptcy and you may reasonable credit history could affect their capability to score an excellent financial. ( Legitimate )

I have a bankruptcy back at my listing, however, my credit rating was upgrading. These days it is 650. Exactly what can i do to be capable of getting a property financing, if that’s even it is possible to? – Don

Hello, Wear. Reconstructing your borrowing from the bank once case of bankruptcy is not any easy task, and i also applaud your progress! A beneficial 650 credit score was a good rating of the FICO requirements, very when you are their get will most likely not yet , end up being in which you’d like that it is, it’s miles on the bad it could be.

You’ll be able to rating a home loan immediately after a personal bankruptcy, and it is you can easily to acquire home financing with a good borrowing from the bank score. Even in the event those people activities together may make it much harder, it’s still you’ll be able to to find home financing if your low, but rising, credit rating is due to personal bankruptcy. The latest caveat, though, is the fact that decrease your rating while the poorer the borrowing background, the greater amount of possible its that you’ll score considering a home loan interest rate which is greater than you’d like.

Solution 1: Give yourself more time

With respect to negative information on your credit history, big date is the best therapist. You didn’t say if the bankruptcy proceeding taken place, nevertheless typically stays on the credit file for approximately a decade, depending on the particular case of bankruptcy.

If you’re able to wait until brand new bankruptcy proceeding drops of the credit file and you will work to alter your results, you have got a simpler time securing a home loan and performing therefore on a great interest.

Choice dos: Run your fico scores today

In the event that it will just take age for the bankruptcy proceeding to-fall out-of your credit file, or if you become strongly one now’s the best for you personally to get a property, your next best bet would be to invest two months improving loans Rosa AL the credit ratings whenever you can.

- Investing their costs promptly every month, because the concurred for the collector.

- Bringing newest towards people early in the day-owed levels.

- Lower mastercard stability.

- Starting a secured charge card so you can expand the combination of credit membership and build a confident fee background.

Choice step 3: Pick a mortgage to possess fair borrowing from the bank

You could shop for a home loan while strengthening your borrowing. Although not, enhancing your results first makes it much easier. Certain types of lenders enjoys all the way down credit score requirements than old-fashioned mortgage loans. Listed below are about three that you may consider:

- FHA finance – Brand new Government Property Government assures these types of mortgages, and this private loan providers build. One may qualify for an enthusiastic FHA loan having a credit get as little as five-hundred (although you would need to make a downpayment with a minimum of 10%).

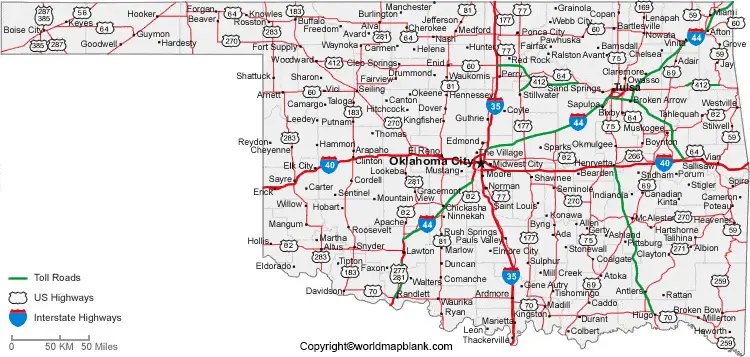

- USDA finance – For those who have a low income and wish to purchase an excellent home in a few outlying parts, you will be in a position to qualify for an effective USDA mortgage. These types of money don’t have any lowest credit history demands.

- Virtual assistant finance – For folks who otherwise your lady is actually experts otherwise productive-obligations solution participants, you might be eligible for a great Va financing, that can doesn’t have minimal credit score requirements.

Keep in mind that as you might possibly be considered getting a beneficial federally supported financing, the fair credit rating and earlier in the day bankruptcy get indicate that it is possible to score a high interest rate or reduced favorable terms and conditions than your create that have increased score and you will clean credit rating.

A last term .

Whether or not interest rates is ascending, the current lowest pricing allow it to be an effective for you personally to purchase an excellent domestic. Yet, if your fico scores and you can personal bankruptcy ensure it is challenging to be eligible for a mortgage during the an effective rate, it might not function as right time to find a home loan.

And it is important to keep in mind that case of bankruptcy simply clears up your obligations (the otherwise a few of it), it doesn’t necessarily resolve the root points. If you are however that have monetary problems, bringing a mortgage is going to make your situation tough.

Happy to find out more? Check out this type of stuff …

- Should you re-finance along with your latest mortgage lender?

You want Legitimateadvice for a money-relevant matter? Current email address our very own Credible Currency Coaches in the A funds Advisor you’ll answer your question during the a future line.

This post is meant for standard informative and you may activity purposes. Entry to this great site will not manage a professional-customer relationship. Any pointers entirely on or based on this amazing site shouldn’t end up being an alternative to and should not getting depended upon as legal, tax, real estate, financial, chance government, or other professional advice. For many who need any such advice, please talk to a licensed otherwise educated elite prior to taking any action.

Leave a Reply