It could be that the cheaper lumber has more knots, therefore forcing workers to throw more of the raw materials in the scrap heap. The responsible managers (e.g. purchasing and production) will have to get together to do more observations and research. It may also be that our expectations are unrealistic and we need to change our budget parameters.

Overhead Variance – Types of Efficiency Variance

Standards are cost or revenue targets used to make financial projections and evaluate performance. For example, if the cost formula for supplies is $3 per unit ($3Q), it is also considered the standard cost for supplies. Managers can use the standard cost formula to make projections about supplies expense or to evaluate the actual amount spent on supplies. Overall, efficiency variance is a vital metric for any manufacturing company that wants to remain competitive in today’s market. By taking the time to understand and address efficiency variance, companies can position themselves for success and achieve long-term profitability. Efficiency variance can result in poor-quality products, leading to dissatisfied customers and a damaged reputation.

Direct Materials Efficiency Variance

Since direct labor hours are the cost driver for variable manufacturing overhead in this example, the variance is linked to the direct labor hours worked in excess of the standard labor hours allowed. This overage in direct labor hours means that $22,500 of additional variable manufacturing overhead was incurred based on the standard amount applied per direct labor hour. Inefficient use of the cost driver used to apply variable manufacturing overhead typically results in additional overhead costs. A template to compute the total direct labor variance, direct labor efficiency variance, and direct labor rate variance is provided in Exhibit 8-6. Because of the cost principle, the financial statements for DenimWorks report the company’s actual cost. In other words, the balance sheet will report the standard cost of $10,000 plus the price variance of $3,500.

Video Illustration 8-3: Computing direct labor variances

The total variances can be calculated in the last line of the top section of the template by subtracting the actual amounts from the standard amounts. The standard quantity allowed of 630,000 feet is subtracted from the actual quantity purchased and used of 600,000 feet, yielding a variance of 30,000 feet. When using the template format presented in this chapter, positive variances are favorable and negative variances are unfavorable. In the NoTuggins example, the total standard direct materials allowed was 630,000 feet.

- A summary of the direct materials, direct labor, and variable manufacturing overhead variances is provided in Exhibit 8-12.

- For instance, procurement teams can work closely with suppliers to negotiate better prices, while production teams can implement process improvements to reduce material waste.

- Per the standard cost formulas, Brad projected he should have paid $315,000 for the direct materials necessary to produce 150,000 units.

- For example, if a company sets a standard of 100 hours to produce 1,000 units but ends up using 120 hours, the labor efficiency variance would highlight this 20-hour discrepancy.

- The difference between this actual expenditure and the actual expenditure on direct material is the direct materials price variance.

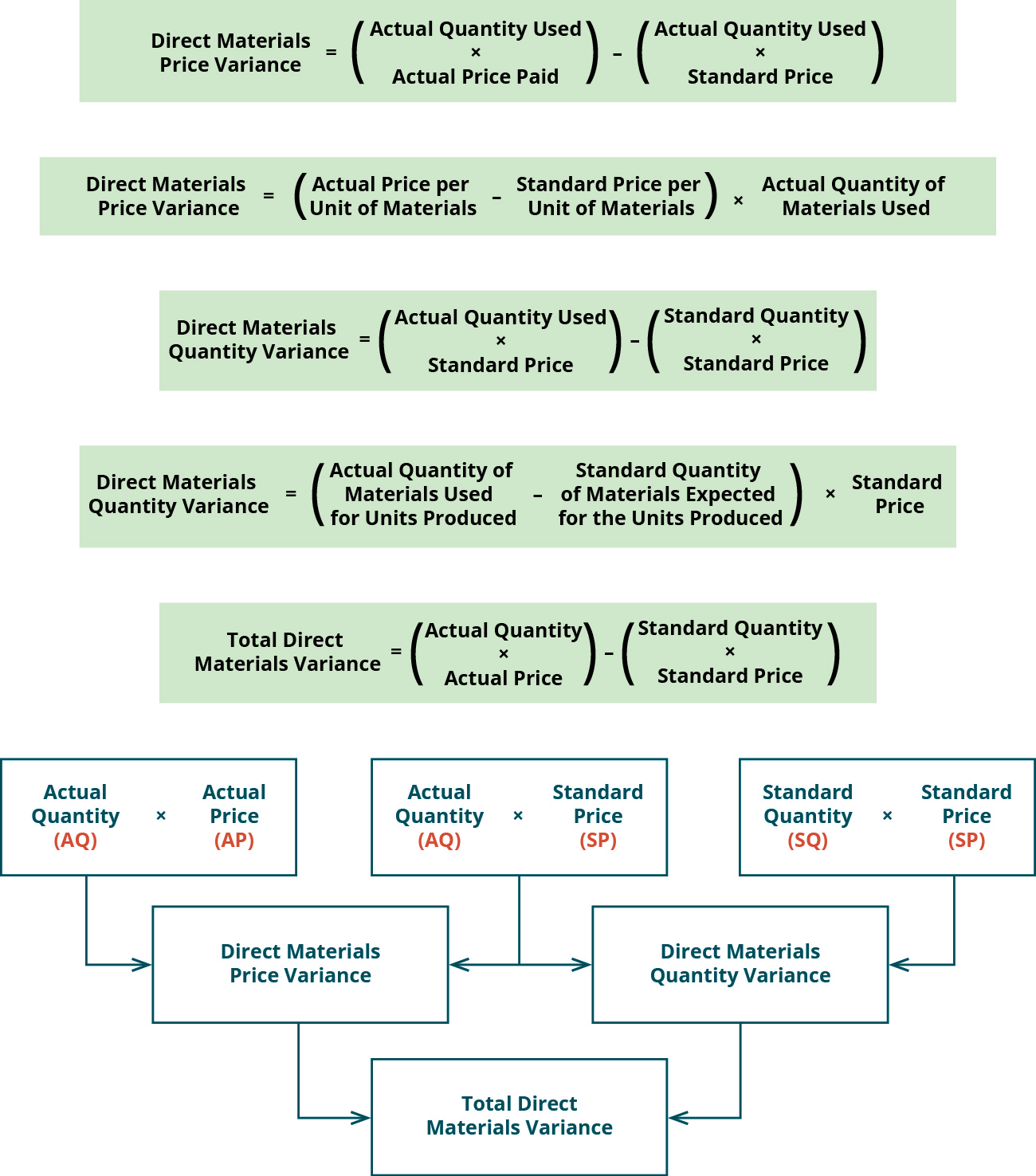

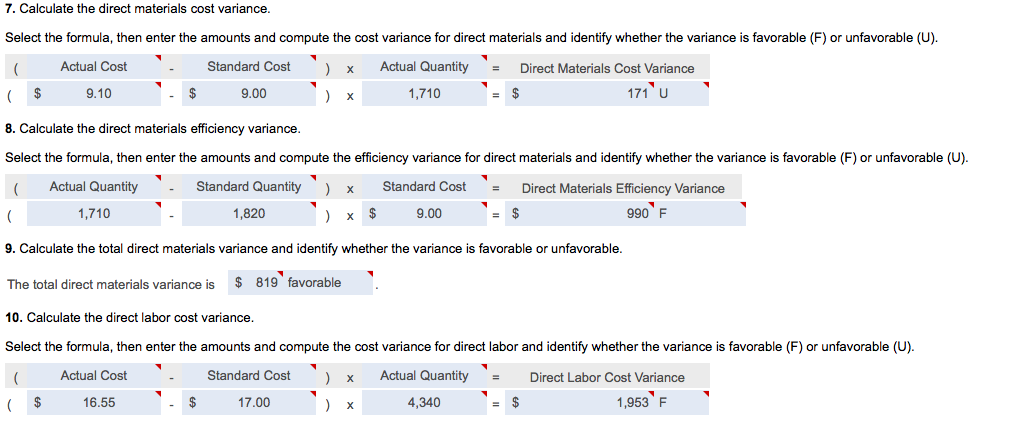

Variances between the standard and actual amounts are caused by a difference in efficiency or rate. The total direct labor variance is separated into the direct labor efficiency and direct labor rate variances. In other words, when actual quantity of materials used deviates from the standard quantity of materials allowed to manufacture a certain number 5 hidden ways to boost your tax refund of units, materials quantity variance occurs. The total direct materials cost variance is also found by combining the direct materials price variance and the direct materials quantity variance. By showing the total materials variance as the sum of the two components, management can better analyze the two variances and enhance decision-making.

With either of these formulas, the actual quantity used refers to the actual amount of materials used to create one unit of product. In this case, the actual price per unit of materials is $6.00, the standard price per unit of materials is $7.00, and the actual quantity purchased is 20 pounds. This is a favorable outcome because the actual price for materials was less than the standard price.

This can occur when information is not shared correctly or when there is a lack of clarity regarding roles and responsibilities. Another way to improve your business performance is to be more efficient — “to work smart,” as the business cliché goes. Let us assume further that during given period, 100 widgets were manufactured, using 212 kg of unobtainium which cost € 13,144. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

By optimizing their production processes, companies can reduce their energy consumption, waste production, and greenhouse gas emissions. This can help them meet sustainability goals, reduce their carbon footprint, and improve their reputation as socially responsible. You have a $7,500 unfavorable price variance and a $10,000 favorable efficiency variance. Because this is a cost variance, a negative number indicates less actual spending than planned, and that’s a good thing. See direct material total variance#Example and direct material price variance#Example for computations of both components.

The material price variance is $7,500 unfavorable because your actual costs ($57,500) were more than the actual quantity at budgeted price ($50,000). Putting material, labor, and manufacturing overhead costs into products that will not end up as good output will likely result in unfavorable variances. Assume your company’s standard cost for denim is $3 per yard, but you buy some denim at a bargain price of $2.50 per yard. For each yard of denim purchased, DenimWorks reports a favorable direct materials price variance of $0.50.

The real reason you go through all of this analysis is to identify areas where you can improve. By “improve,” you want to reduce costs, increase demand, or raise prices to generate a higher profit. Accounting professionals have a materiality guideline which allows a company to make an exception to an accounting principle if the amount in question is insignificant. The products in a manufacturer’s inventory that are completed and are awaiting to be sold. You might view this account as containing the cost of the products in the finished goods warehouse. A manufacturer must disclose in its financial statements the amount of finished goods, work-in-process, and raw materials.

Leave a Reply